What is open banking: Everything you need to know

Last editedSep 202315 min read

What is open banking?

Open Banking refers to banks and other financial institutions opening up data for regulated providers to access, use, and share.

Ensuring security for a data-sharing project such as open banking is paramount and banks are effectively putting in place the infrastructure for their customers’ data to be shared more securely with third parties, with customer permission. That data sharing takes place only with customer authorisation is important. Open banking wasn’t designed to allow banks to sell their customers’ data more easily.

The intention is quite the opposite — open banking was conceived to improve financial services for customers, by opening up access to data that has historically been kept in-house new companies and new products can enter the market and use this data in helpful, innovative ways.

So what does it all mean?

For financial service providers — At the top of the chain, open banking will allow financial service providers to significantly innovate their product offerings to businesses.

For businesses (large and small) — Those innovations made by financial service providers will mean more effective and efficient financial tools in your business — notably payments. This will mean more automation, freeing up more time, doing away with the headaches of manual tasks, and ultimately saving you money.

For customers — Open banking will mean better ways to spend, borrow, and invest.

What problems is open banking solving?

There’s not a specific major problem open banking is solving. Instead, in the simplest terms, open banking is trying to spark competition and innovation in the financial services sector, to create better products and experiences for businesses and consumers.

Some broad problems that open banking can help solve include:

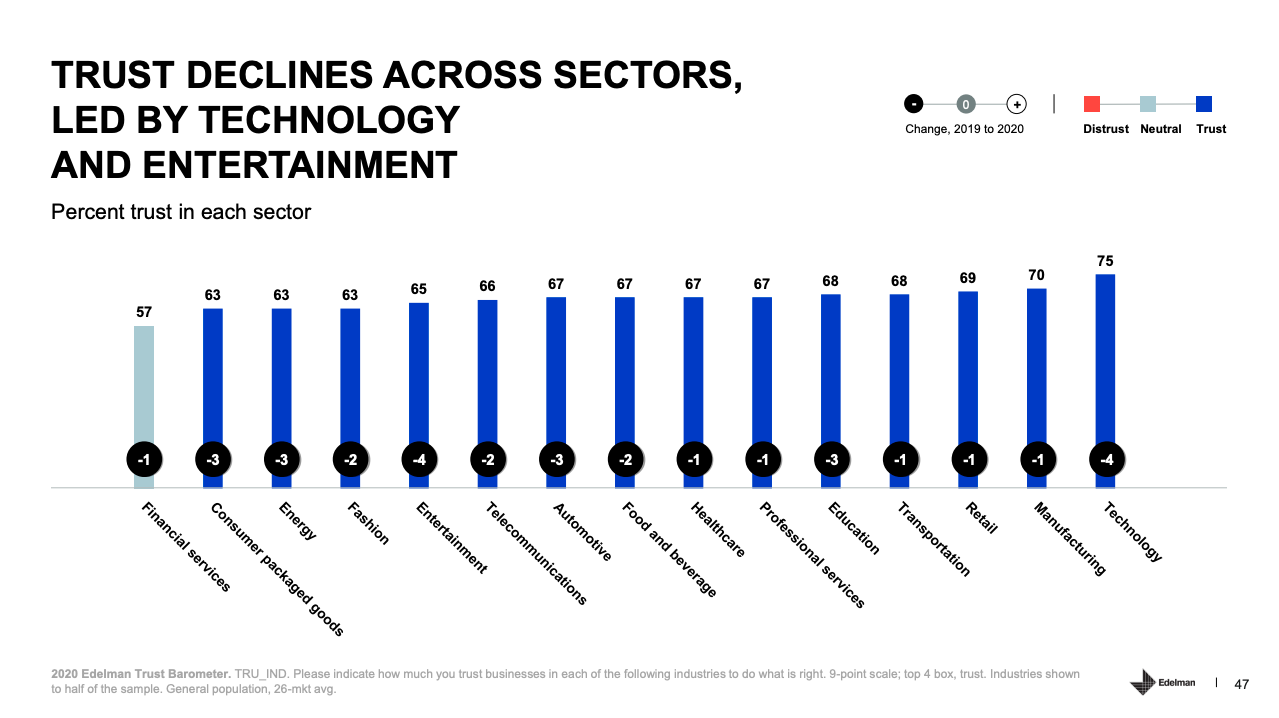

poor trust in banks (see image below)

friction caused by data and processes being very tightly built into the banking product

(Above: Financial services is the least trusted industry sector, according to the Edelman Trust Barometer 2020.)

Some opportunities that open banking strives for include:

Helping people to better transact, save, borrow, lend and invest their money

Reduce overdraft fees

Improve customer service

Increase your control over your financial data

How does open banking work?

Technologically speaking, open banking relies on APIs (application programming interfaces). An API is just a structured way for one program to offer services to another program. Or, put even more simply, it’s just a way of helping software speak to other software.

Think about the data we’ve covered above — account holder’s name, account type, currency, etc… APIs are effectively the instructions for how a third party can access that data from a bank.

(Fun fact: GoCardless has its own API.)

Once these APIs are agreed upon by everyone involved in the open banking initiative (e.g. the government, regulators, and banks), it’s up to the banks to build and implement them. Once they have, businesses can start accessing them and building new and innovative products using them. The customers of these businesses — which could be consumers, small businesses, or even enterprise companies — would then ultimately benefit by using these innovative products.

Open banking use cases

Key examples include:

Better payment solutions for businesses — With the payment initiation side of open banking, businesses could use payment products that improve cash flow, lower costs, increase visibility and control, and reduce fraud.

Better borrowing terms — If you don’t have much credit history, you could be prevented from getting favourable borrowing terms. But with open banking, your historical bank account data can be accessed by lenders to help better demonstrate your creditworthiness.

Better financial management — By accessing your account data, open banking products could analyse all the money coming into and going out of your accounts, helping you better identify problem areas and opportunities (e.g. lower fees, better interest).

Account aggregation — Essentially, being able to see all of your accounts in one place. Instead of having to log in to multiple different accounts in your web browser, or switch between multiple apps on your phone.

What data does open banking help “open up”?

Open banking is “opening up” in three broad areas: account data, product data, and payment initiation.

Account data

Account data is what you’d expect. Things like:

Account holder’s name

Account type

Currency

Date the account was opened

Transaction info (e.g. amounts, merchants, etc.)

Product data

Product data is around the products and services a financial institution might offer. For example, historically, you would have to go into a bank branch to find out what they can offer you as a customer. Now you can give them a call, or better yet, browse their website.

But with open banking, this info is put into a standard format, which makes it easier for others to show you the best options for you. (Imagine your accounting software automatically telling you when you’re better off switching banks and showing you exactly which account to go for.)

Payment initiation

Payment initiation is all about making payments from one bank account to another. But instead of having to log in to online banking and manually go through the payment process step-by-step, open banking can initiate this process via other software, apps, or websites. It can also be sped up — provided the account holder explicitly consents.

There are also significant benefits for the recipient of the funds. Imagine how many payments a large utility company gets that are for the wrong amount with the reference “electricity” and therefore can't ever be reconciled! Open banking will solve that issue.

What are the benefits of open banking?

Convenience

Cost reduction

Personalisation

Improved decision-making

These are the broad benefits open banking is bringing to the market. Not just for consumers but also for businesses.

By securely opening up access to your banking data (with your consent), two things happen:

There’s a new swathe of highly-useful financial information about you or your business that can now be used by software products, to your benefit.

Entirely new software products can be created, encouraging new entrants to the market to innovate and compete for your business.

Thanks to this openness and competition, you’ll be able to get financial products better tailored to your specific needs and are likely to see costs go down.

It’s also inherent that with access to more of your financial data, you’ll see financial products using this to get better and better at helping you make beneficial decisions.

Expect to see things like:

All-in-one overviews — Aggregation of all your financials, spanning bank accounts, credit cards, investments, loans, pensions and more, all in one place.

Increased availability — For some, things like good borrowing rates just aren’t available. And others may just be flat-out denied. But with new access to banking data, consumers and businesses who have historically been left out will gain newfound access to certain financial products.

More automation — With banking data becoming open and accessible in a standardised way, expect products to further automate currently-manual tasks and to see an increase in “robo-advice”.

Improved online payment experiences, such as Instant Bank Pay — where businesses and their customers will be able to make and take bank-to-bank payments that are faster, more flexible, and rivalling (or even replacing) card payments.

Advantages of open banking for businesses

More competition, fewer barriers to entry

Banking used to be one of the most rigid, legacy-burdened industries in business. Consumers would open a bank account, and all their data would be centrally stored and kept with that one bank, creating an inefficient dependency between consumers and financial institutions.

There was no room for small businesses to enter this sector since banks and building societies were set to dominate the space.

With the introduction of open banking, new players have access to the same data as big banks, allowing them to innovate and create new, more affordable alternatives to traditional financial services. Open banking has democratised the space, tearing down barriers to entry.

Banks will have to improve their offerings

Increasing competition will benefit banks as well. It’s important to highlight that open banking does not aim to put traditional banks out of business. If anything, it’s an opportunity for them to rise to the challenge and take steps towards a more digital, customer-centric future.

It’s not a coincidence that traditional banking institutions have recently released banking apps and online banking solutions for their customers, allowing them to benefit from a better experience and better deals. Banks are witnessing the FinTech evolution happening right in front of them, and they are embracing change by adopting the new tech.

Increased customer engagement, a greater chance at success

Open banking improves the relevance of services suggested to consumers, which innately increases the chances of customer engagement. The more personalised service is to a customer’s needs, the greater the chances the customer will interact with the brand.

Advantages of open banking for consumers

The bank is in their hands

We used to have to ask bank managers for a few spare hours of their time to sort out our bank obligations while having to stand in queues outside our local bank branch.

Those days are gone. Digital banking has brought the bank to the palm of our hands, and open banking is making it stay there. Open banking gives consumers a different depth of services from what traditional digital banking used to do. Now, it’s so much more than checking our account balance.

Open banking makes the banking experience interactive, as it proactively advises people on their financial well-being based on advanced analytics.

Consumers are in control of their finances

The relationship between traditional banking institutions and consumers used to have very defined parameters — banks had the lion's share of the power, and consumers were the ones in need of banks. Open banking is shifting the balance of power, putting customers in the driver’s seat.

By opening up financial data and unleashing the power of analytics, open banking has made financial services a fair playing field for traditional banks and FinTech companies alike. Consumers not only have more choices about their financial service providers, but they are the only decision-makers when sharing their data.

Banks are no longer the de facto keepers of personal data. Open banking has given that right back to the consumer.

All the information they need is centralised

To make the best financial decisions, consumers need to have access to as much information as possible to ensure the best possible outcome. With all accounts linked together by an app and available on a single platform, open banking is helping you make the most beneficial decision for your financial well-being.

With open banking, consumers have an ally, a partner looking out for them. Not all of us have the business acumen or foresight to plan, budget, and invest in the best way possible. Open banking technology analysis of our habits picks up on trends — finding tailored banking products that fit our profile, and helps us manage savings accounts much more efficiently.

On top of that, it also helps make purchases online easier, faster, and more secure through a regulated payment provider.

Challenges facing open banking

Resistance to change and misinformation

Open banking faces the same challenge every new type of technology faces when instituting a change to how things have been done for long periods of time — misinformation and lack of trust.

It takes time for a concept to prove itself to the public, and in all fairness, open banking is doing pretty well in powering through this first wave of resistance. Considering it came into effect in January 2018, 24.7 million individuals worldwide have already used open banking services in 2020, and is forecasted to reach 132.2 million by 2024.

Removing the human element — building a purely digital brand

Removing the need for a banker or waiting in line for hours is a major benefit for consumers, but at the same time, it poses a major challenge for banks. By removing the human element, banks lose a major competitive advantage in their branding and customer retention efforts.

Many consumers used to correlate their bank allegiance with the level of relationships they developed with their banker or the person who served at the register in their local branch. With open banking empowering the move to a completely digital offering, any financial organisation will now be judged purely on the strength of its financial products.

The brand used to be its people, and now it becomes the product and the service efficiency it provides. That’s a huge adjustment banks need to make.

Regulation is playing catch up

Open banking essentially proposes the idea of unbundling retail banking services, creating more layers and segments. With financial regulation already being a huge undertaking for the more compact, traditional financial system, regulators are now faced with a greater challenge.

They will need to find new ways and more resources to oversee a much more fragmented financial ecosystem that will keep growing exponentially.

To add more obstacles and raise the level of difficulty for regulators, this ecosystem will include non-financial services companies performing either regulated activities or acting as third-party providers of outsourced critical functions.

Christine Lagarde, the Managing Director of the International Monetary Fund, explains this new reality for regulators:

“Traditionally, regulators have focused on overseeing well-defined entities. But as new providers come on stream in new shapes and forms, fitting these into buckets may not be so easy. Think of a social media company that is offering payments services without managing an active balance sheet. What label should we stick on that?”

Open banking security — how safe is your data?

Open banking is as safe as traditional digital banking. If you trust any digital banking activity, such as sending money from your smartphone, there is no reason why you shouldn’t trust open banking technology.

If anything, the API technology was designed to make the access, transfer, and management of information more secure. Access to APIs is safeguarded by specific banking industry standards such as the PSD2, which require technical authorisation, user authentication and consent.

For example, open banking in the UK is regulated through the Payment Services Regulations (2017), bringing the PSD2 into law. In the European Union, each member state has a specific regulatory entity responsible to enforce all the needed measures to ensure the safety of open banking.

Couple that with the fact that the technology requires integration with web single sign-in and Identity and Access Management (IAM), and what you have is layers upon layers of security that fortify your data.

Is open banking safe?

The short answer — is an undeniable yes. With regulated APIs, both the bank and external providers can guarantee safe and easy access to transaction data and even initiate payments on the customer’s behalf. Open banking is also more secure than screen scraping because there is no need to share passwords and user credentials to access your financial data.

Know more about safety measures and procedures within open banking in our dedicated article.

Open banking in the UK 🇬🇧

Overview

In the UK, open banking is guided by the Open Banking Standard (OBS) — a framework published by the Open Banking Implementation Entity (OBIE, trading as Open Banking Limited).

The OBIE is a company that was established by the Competition and Markets Authority (CMA) to oversee the implementation of the Open Banking Standard. It’s governed by the CMA and funded by the UK’s nine largest banks and building societies: Allied Irish Bank, Bank of Ireland, Barclays, Danske, HSBC, Lloyds Banking Group, Nationwide, RBS Group and Santander.

Open banking in the UK is regulated by the Financial Conduct Authority (FCA).

While all these entities are involved in the design and implementation of open banking in the UK, there are four core parties involved in “using” open banking:

Account providers — Such as banks and building societies. Also referred to as Account Servicing Payment Service Providers (ASPSPs). These are the organisations that implement the Open Banking Standard, allowing their customers’ data to be accessed by third parties when consent is given.

Third-party providers — Also referred to as Account Information Service Providers (AISPs - for accessing account info) and Payment Initiation Service Providers (PISPs - for making payments). These are the businesses innovating, creating products and services that use the newly-accessible customer data held by banks.

Technical service providers (TSPs) — Companies that work with regulated providers to deliver open banking products or services. TSPs collaborate with account and third-party providers to help deliver open banking products and services.

Consumers — Both individuals and businesses. They ultimately benefit from the open banking products and services developed by third-party providers.

Examples of open banking in the UK

Some examples of open banking features on the market right now include:

There are many more, including 40+ Open Banking apps and products that are currently listed on the Open Banking app store.

Timeline of open banking in the UK

Jul 2013 — The European Commission publishes a proposal for a revised PSD2. The recommendation is that account providers (e.g. banks) allow third parties to access account data and initiate payments when they have consent — the foundation of open banking.

Sep 2014 — The Open Data Institute and Fingleton Associates publish a report recommending that banks create standardised APIs to allow third-parties access.

Jan 2016 — The final PSD2 text is published in the Official Journal of the EU. EU member states are required to apply the majority of provisions within 2 years.

Feb 2016 — Initial set of open banking guidelines published by HM Treasury, indicating how open banking data should be created, shared, and used.

Aug 2016 — The CMA publishes a report on its investigation into the UK’s retail banking market.

Sep 2016 — The Open Banking Implementation Entity is formed.

Mar 2017 — Open Data launches, which makes product info, branch locations and opening times, and ATM locations available.

Jul 2017 — Specifications are issued for account information and transaction and payment initiation.

Oct 2017 — Open Banking Directory enrolment launches for regulated participants.

Jan 2018 — The PSD2 deadline arrives for EU member states. All payment service providers must allow third parties open access to customer account data and payment services. This applies to all payments where one provider is in the EEA.

Jan 2018 — In the UK, the CMA 9 deadline arrives. The nine largest UK current account providers must provide an open API for current accounts. The Open Banking Standard launches.

Mar 2018 — Version 2 of the Open Banking Standards is released.

Sep 2018 — Version 3 of the Open Banking Standards (including Customer Experience Guidelines) is released.

Sep 2019 — The PSD2 RTS deadline arrives, prohibiting access to data beyond that which has been explicitly authorised by a customer. Screen scraping techniques are also to be banned, and strong customer authentication is required for electronic payments.

Frequently asked questions

🗣 Which banks use open banking?

Only the UK’s nine largest banks and building societies (also known as the CMA9) are required to make data available via open banking. They are:

AIB Group UK (trading as First Trust Bank in Northern Ireland)

Bank of Ireland UK

Barclays Bank

HSBC Group (including First Direct and M&S)

Lloyds Banking Group (including Bank of Scotland and Halifax)

Nationwide Building Society

NatWest Group (including NatWest, Royal Bank of Scotland and Ulster Bank NI)

Northern Bank Limited (trading as Danske Bank)

Santander UK

Other UK banks and building societies can choose to take part in open banking, but aren’t required to. The Open Banking Implementation Entity lists the following additional banks and building societies as currently offering open banking:

Arbuthnot Latham & Co Limited

BFC Bank

C Hoare & Co

Clydesdale Bank

Contis

Coutts & Company

Coventry Building Society

Creation Financial Services

Cynergy Bank

Ghana International Bank

Hargreaves Lansdown Savings

ICBC (London)

Industrial and Commercial Bank of China

Investec

MBNA

Metro Bank

Mizuho Bank

NewDay

Permanent TSB

Prepay Technologies

Project Imagine

Revolut

Sainsbury’s Bank

SG Kleinwort Hambros Bank

Starling Bank

Tesco Bank

The Co-operative Bank

The Governor and Company of the Bank of Ireland

The Royal Bank of Scotland

The Royal Bank of Scotland International

Tide Platform

TSB Bank

Turkiye Is Bankasi As

Union Bank of India

Vanquis Bank

Virgin Money

Wirepayer

Yorkshire Building Society

🗣 How safe is open banking in the UK?

Like all good financial technologies, open banking is designed to be very secure. It’s implemented by banks, so is subject to their rigorous security measures.

The consumer is always in charge of who is granted access to their data, and this access can always be revoked if they wish.

And if fraudulent payments are made, your bank or building society will pay your money back under appropriate circumstances.

In addition, open banking products and services are regulated by the FCA (or the European equivalent, if they’re located in the EU), and consumers are also protected by data protection laws and the Financial Ombudsman Service.

🗣 Is PSD2 open banking?

PSD2 is not the same as open banking, but the two are closely related.

PSD2 is an EU regulation intended to increase competition and innovation in the financial space. It removes the monopoly banks have on the use of customer data, allowing other businesses to use that data as well, with the customer’s permission.

Open banking is a secure way for providers access to your financial information in the UK. It was a result of PSD2, but they are not the same thing. PSD2 requires banks to open up access to customer data (and remember: it’s only shared with your consent), but open banking specifies a standard format for the process.

Open banking also improves the online payment process, allowing customers to make payments directly from their bank account, which can directly authenticate the transaction.

🗣 Can I use the open banking APIs?

Yes. Getting started using the Open Banking APIs depends on whether you’re a:

Third-party provider (Account Information Service Provider / AISP, or Payment Initiation Service Provider / PISP)

Account provider (Account Servicing Payment Service Provider / ASPSP)

Technical service provider (TSP)

For third-party providers, enrolling with open banking takes 4 steps:

Get regulated — You may already have the required regulatory permissions. If not, apply to the FCA or European equivalent.

Enrol in the Open Banking Directory — This is optional, not required, but is an important part of the open banking ecosystem, as it shows off the verified details of all participants.

Test your service in the Directory Sandbox — Once your identification and validation checks are successful, you can test your service here with dummy data.

Go live — Once your regulatory status is confirmed by the FCA or European equivalent, and your enrolment is complete, you’ll be added to the live Open Banking Directory. You can start connecting with account providers to test your service. And when you’re ready, you can launch your service with customers.

For account providers, the Open Banking Standard is free to use. The Open Banking Implementation Entity also offers additional optional services:

Conformance and Certification

Open Banking Directory

Dispute Management System

For technical service providers, becoming part of the Open Banking Ecosystem takes 4 steps:

Deciding your service — Before you begin, you need to know who you’ll be serving, and what you’ll be offering. This could be infrastructure or a particular type of product or service.

Join the Open Banking Directory Sandbox — You’ll need to provide a primary business and a primary technical contact (they can be the same person or different people), your company name and number as they appear on the Companies House register (or European equivalent) and as they have been or will be used if you apply to the FCA (or European equivalent) to become regulated.

Test your service in the Directory Sandbox — Once checks are completed successfully, you can use the Directory Sandbox.

Partner with open banking providers — You can use the OBIE’s list of regulated third-party providers and regulated account providers as your starting point if you’d like.

🗣 What is an open banking credit check?

A new kind of credit checking is powered by directly accessing the financial information your bank holds on you, using open banking.

They differ from traditional credit checks, which instead typically rely on third parties whose business it is to build a profile of your credit history. These credit checks will look at things like:

Do you pay your credit back on time?

How much credit do you currently have?

How well do you manage your credit?

New, open banking-powered credit checks directly access the financial data your bank holds on you, with your consent. The advantages of this are:

Freshness — Rather than working off historic data sourced from third parties, Open banking credit checks work off the most up-to-date info straight from your bank.

Accuracy — Traditional credit checks don’t give the full picture of your financial situation. Opening up your banking data helps the credit checker better assess the risk of giving you credit.

Speed — Well-built open banking credit checking services could take advantage of the standardised nature of open banking and use full automation to run a faster end-to-end credit checking process.

Better rates — Ultimately, the more data a credit checker can get on your financial situation, the better-informed they are of the risk you pose, and ideally, this results in a better rate for you.

A great example of the benefits of open banking credit checks is a young person applying for their first mortgage. If they’ve been financially responsible and lived within their means, been renting their accommodation, and haven’t taken out a loan for a car or any other major purchases like that, they potentially have a very thin film upon which a favourable credit assessment can’t be performed, via a traditional credit check.

They’re likely to be granted very unfavourable terms, despite having lived very financially responsibly. This is where open banking credit checks can save the day — by opening up the data from their bank to a mortgage provider, the mortgage provider could see, for example, their long history of paying rent on time. With this data to hand, the mortgage provider could assess the applicant as a lower risk than a traditional credit check would, enabling them to offer more favourable terms.

GoCardless and open banking

In 2020, we completed a $ 95 million funding round to accelerate our investment in open banking.

We've since released our first open banking-powered feature in GoCardless — Instant Bank Pay. Instant Bank Pay complements the existing Direct Debit functionality of GoCardless with a simple, convenient way to collect one-off payments.

Alternative options for one-off payments were limited:

Cards have expensive transaction fees

Bank transfers offer a poor customer experience

Direct Debit is not optimised for one-off payments

Instant Bank Pay payments are confirmed instantly, which means better visibility for you and your customers, less time spent chasing one-off payments, and a smoother customer experience.

In line with the company’s open banking strategy, GoCardless acquired Nordigen in 2022. The Latvian freemium open banking data provider allows GoCardless to add next-generation in-house open banking connectivity to its account-to-account network.

In addition, the acquisition will provide a range of high-quality data products that can enhance outcomes across various applications, such as credit assessments and customer engagement.

Bank Account Data

Bank Account Data enables businesses of all shapes and sizes to quickly access information, to make decisions on their customers, build products and services, or create efficient internal processes.

Instant Bank Pay

Complement your recurring payments with a simple, convenient way to collect one-off payments powered by open banking.

Are you a GoCardless partner? Check out our dedicated Instant Bank Pay page for partners.